Submitted by Mary Bottari on

On Friday, the Wall Street Journal reported that President Obama's signature financial reform, a Consumer Financial Protection Agency (CFPA), was in trouble in the Senate.

On Friday, the Wall Street Journal reported that President Obama's signature financial reform, a Consumer Financial Protection Agency (CFPA), was in trouble in the Senate.

Senate Banking Chairman Chris Dodd (D-Conn.) was considering dropping the idea of creating an independent, stand-alone consumer protection body, empowered to crack down on banking abuses, in order to get a regulatory revamp passed this year with bipartisan support. Dodd is apparently considering shrinking the CFPA into a division of an already-existing federal agency (no doubt one with a proven track-record of failing consumers.)

Dodd is faced with a dilemma. Although he introduced a rather strong financial services reform bill in Congress last year -- one which creates an independent CFPA, curtails the powers of the Federal Reserve and tackles many Wall Street abuses -- it appears that big bank lobbyists who have spent millions fighting reform are now chipping away at his bill.

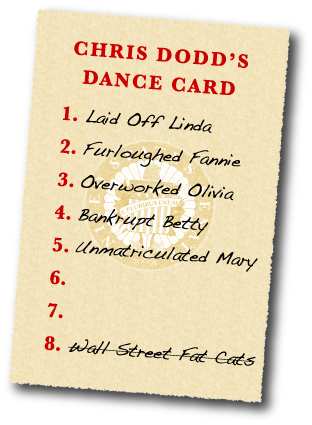

On January 6th, facing an impossibly tough re-election fight, Dodd announced that he was stepping down at the end of 2010. Analysis was mixed about what this would mean for bank reform, but Politico reported that one financial service lobbyist crowed: "Now that Dodd is retiring, he can ignore the demands of the special interests on the left (consumer groups, trial bar, unions) and dance with the special interests that brought him to the dance in the first place. Us, his loyal donors in the banking community."

Today, BanksterUSA released its new video, which calls upon Senator Dodd to dance with the people and not the special interests. The video features Harvard Law Professor Elizabeth Warren, who came up with the idea of a Consumer Financial Protection Agency. Warren makes the simple argument that if America has an independent regulatory body to police toasters so they cannot burn down your house, why don't we have an independent regulator to police deceptive mortgages that can put you out on the street?

The video also features Jamie Dimon, chief executive of JPMorgan Chase, the largest bank in America based on market capitalization. The focus on Dimon is particularly timely. Dimon's firm survived the great meltdown, absorbed the failing Washington Mutual and Bear Stearns, received billions in bailout funds and other government benefits which allowed the firm to prosper in 2009. Dimon has been lobbying hard against any size cap on big banks, and he has been touted as a replacement for U.S. Treasury Secretary Timothy Geithner, who has come under fire for his mishandling of the AIG bailout while head of the New York Fed.

On Friday, JPMorgan Chase announced $11 billion in earnings for 2009, and an eye-popping $27 billion in bonuses. The New York Times dryly reported that the bonus numbers "underscored the gaping divide between the financial industry and the many ordinary Americans who are still waiting for an economic recovery."

Senator Dodd is considering having his first hearings on financial reform at the end of January. Now is the time to "Fill Dodd's Dance Card" by signing our petition to send Dodd the message that the American people expect him to make protecting Main Street his legacy, not dancing with Wall Street. Dodd's committee must pass meaningful reform, even if that means kicking big bankers like Jamie Dimon out of the ballroom and telling Senate Republicans "no deal" on a weak package of reforms.

Comments

iRa replied on Permalink

Your blogs and "Dodd's Dilemma"